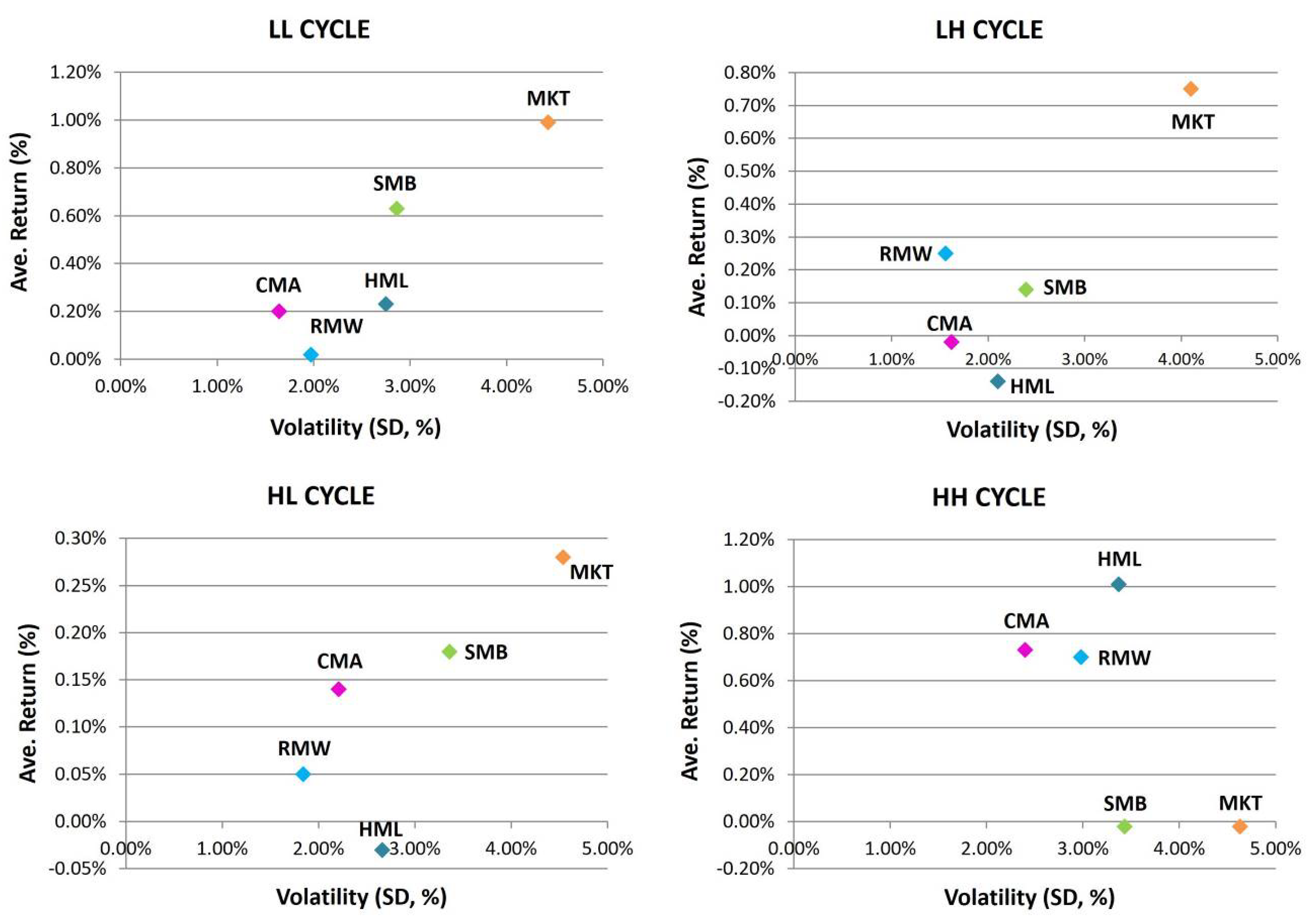

JRFM | Free Full-Text | Factor-Based Investing in Market Cycles: Fama– French Five-Factor Model of Market Interest Rate and Market Sentiment

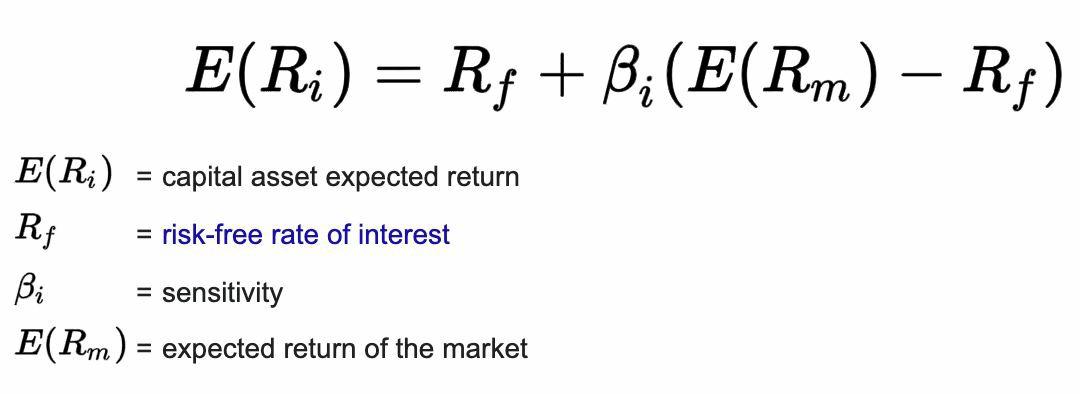

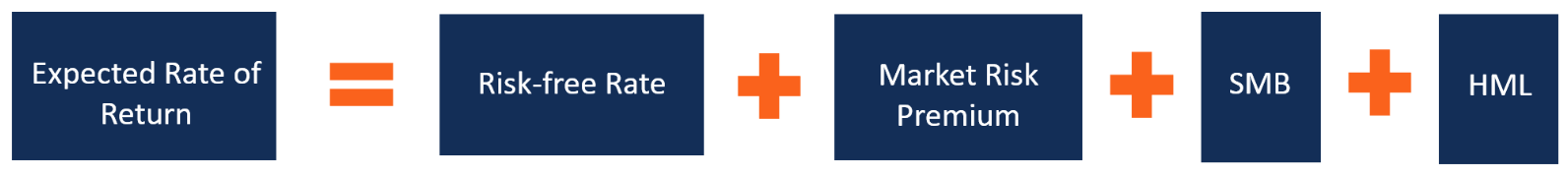

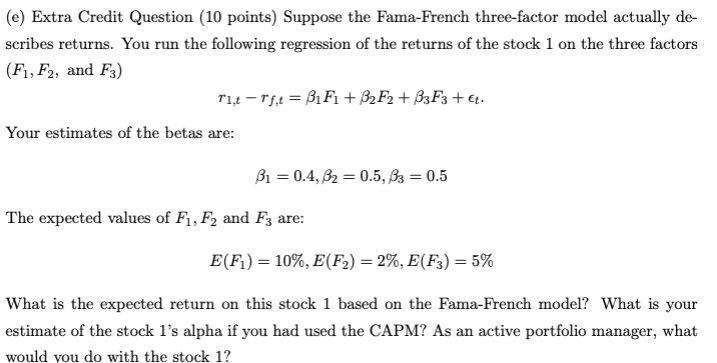

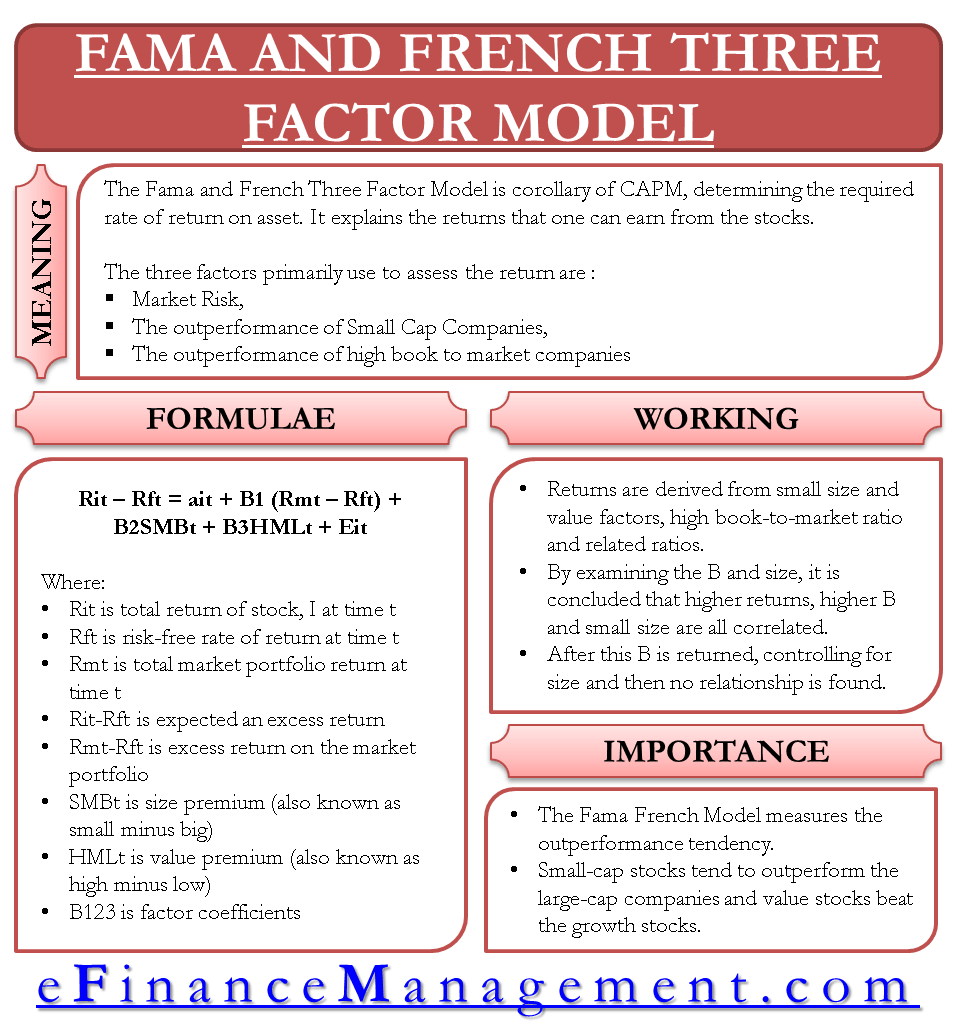

SOLVED: Fama-French Three-Factor Model An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 11%, the return on the SMB portfolio (rSMB) is 3.6%,

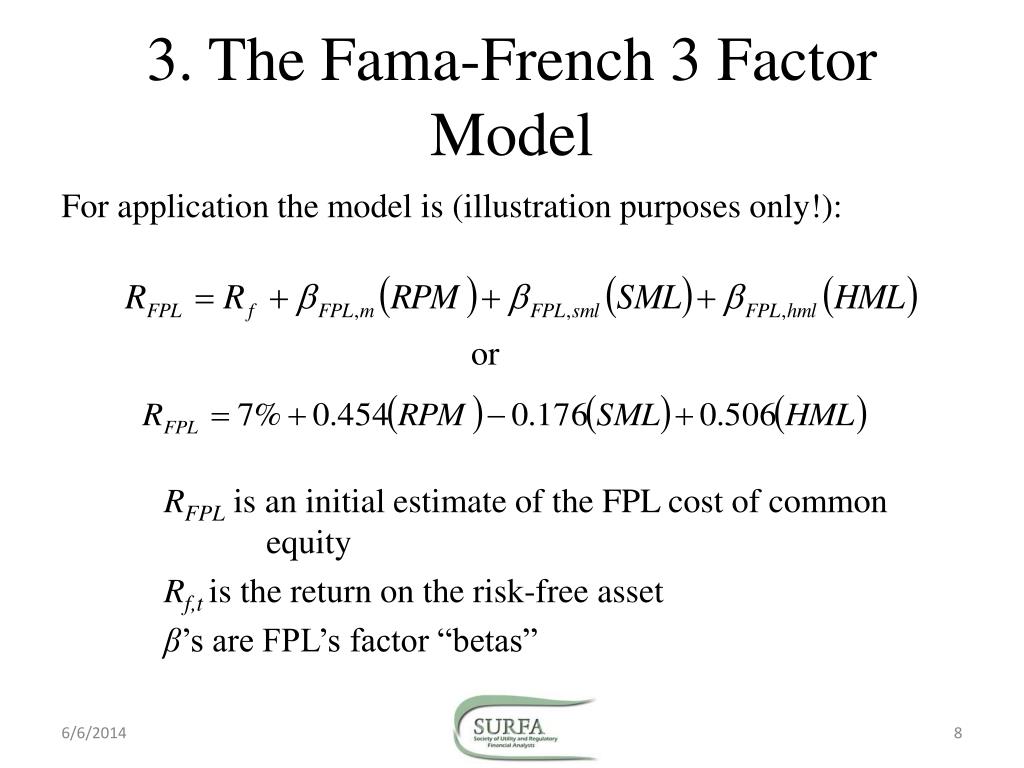

PPT - Fama -French 3-Factor Model: Theoretical and Conceptual Underpinnings PowerPoint Presentation - ID:1271475

:max_bytes(150000):strip_icc()/fama-4196653-b2f48bc85216461ab6f626e63818552c.jpg)